Planning for life’s expenses can feel overwhelming, especially when faced with unexpected costs or major financial goals. That’s where a sinking fund can make all the difference. In this article, we’ll explore what a sinking fund is, why you need one, and how to set one up to support your financial health.

What Is a Sinking Fund?

A sinking fund is a dedicated savings strategy where you set aside small, manageable amounts of money over time for a specific expense. Unlike a general savings account, a sinking fund is focused on one goal—whether it’s a large purchase, an annual bill, or an unexpected repair.

Examples of sinking funds include:

- Short-Term Goals: Car repairs, holiday gifts, or medical bills.

- Medium-Term Goals: Vacations, major appliances, or furniture.

- Long-Term Goals: Weddings, down payments, or college expenses.

By breaking down your goals into categories like these, you can better organize your finances and ensure you’re prepared for both planned and unexpected costs. For instance, setting up a sinking fund for car repairs means you won’t need to scramble when the mechanic gives you an estimate. This clarity and focus make sinking funds a cornerstone of effective financial planning.

Why Do You Need a Sinking Fund?

- Avoid Financial Stress

A sinking fund minimizes the panic of unexpected expenses. It allows you to prepare for predictable costs—like home repairs or holiday gifts—without dipping into your emergency fund or relying on credit cards. Remember, emergency funds are for unforeseen expenses like your car breaking down or sudden loss of employment.

- Achieve Financial Goals

Whether you’re planning a dream vacation, saving for a new car, or covering back-to-school expenses, a sinking fund breaks large financial goals into smaller, manageable steps.

- Stay Disciplined

Sinking funds encourage consistent saving habits. By regularly contributing to these accounts, you strengthen your budgeting skills. Avoid common budgeting mistakes and set yourself up for success.

- Separate Your Savings

Unlike a general savings account that holds funds for various purposes, sinking funds offer clarity by keeping money earmarked for specific goals.

How to Set Up a Sinking Fund

Setting up a sinking fund is simple and can be tailored to your unique needs. Follow these steps to get started:

- Identify Your Goals

What are you saving for? Examples include car repairs, annual insurance premiums, or a family vacation. If you’re unsure, check out common expenses to include in your budget.

- Calculate How Much You Need

Determine the total cost and the time frame. For example, if you need $600 in six months, plan to save $100 per month.

- Choose a Saving Method

- Open a separate account for each sinking fund.

- Use a spreadsheet or budgeting app to track progress.

- Automate Contributions

Set up automatic transfers to your sinking fund accounts. This ensures consistency and removes the temptation to spend.

- Monitor and Adjust

Periodically review your sinking funds and adjust contributions if needed. Life happens, and your goals may change over time.

Sinking Fund vs. Savings Account

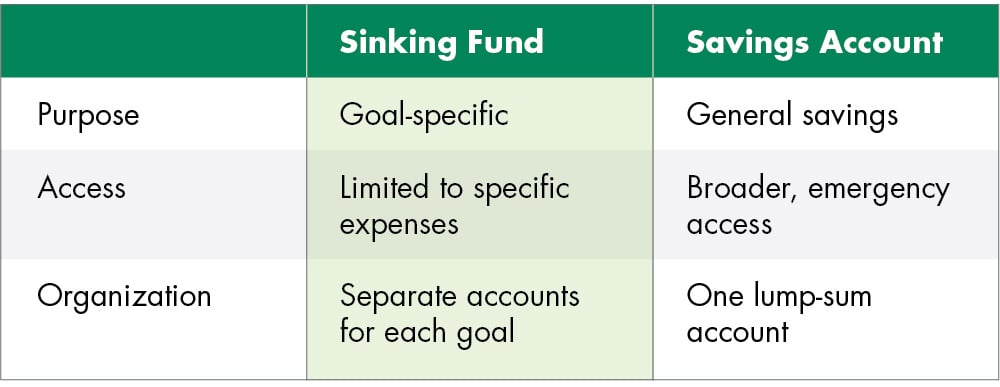

While both sinking funds and savings accounts serve important financial purposes, they have key differences:

Learn more about how to create the right budget for you to decide where sinking funds fit into your financial strategy.

A sinking fund is a simple but powerful tool to help you prepare for future expenses, avoid financial stress, and stay disciplined with your savings. By starting small and focusing on one goal at a time, you can build confidence in your financial planning. Whether you’re saving for a dream vacation or managing annual bills, sinking funds make large expenses feel manageable and achievable.

Ready to take control of your financial future? Explore savings tools to start your first sinking fund today!