By now, almost all of us have been the target of some sort of online scam. They come in all shapes and sizes, and they come from many different sources and channels. Hackers, scammers, bot handlers, spoofing, phishing, vishing, and more. In the end, almost all online scammers are looking for an easy way to get personal or financial information, or both.

One of the easier ways for cyber criminals to take advantage of unsuspecting consumers is through text message scams. There are still plenty of people out there who don’t expect to encounter unknown senders through text messages. But it’s happening more and more and it’s important to educate yourself and protect both yourself and those around you.

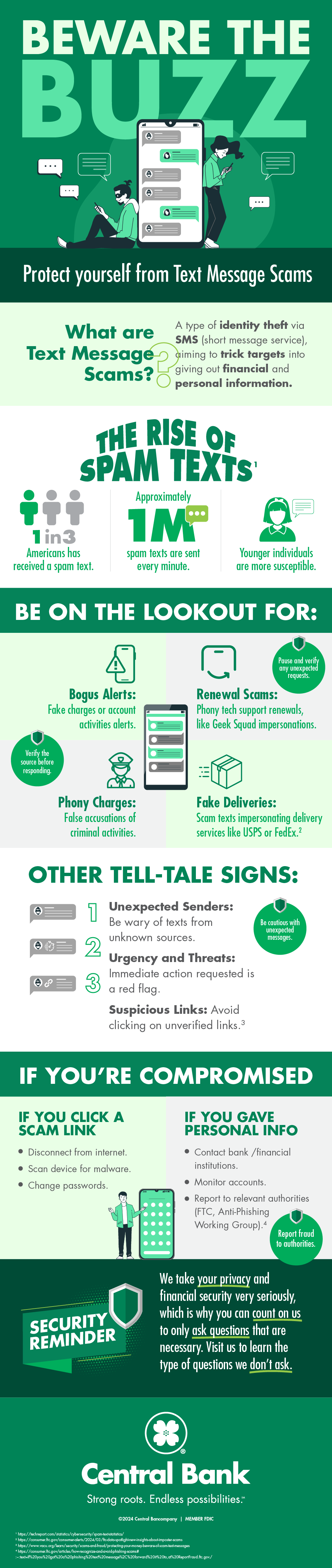

Key Spam Text Statistics

- Deliveries sector records the most victims from spam texts.

- 1 in 3 Americans has received a spam text.

- The spam text rate dropped during the COVID-19 pandemic.

- California tops the chart in America for the most scammy texts.

- 59.4% of victims ever recorded were male.

- Interestingly, young people are more likely to fall victim to bad players using scam texts.

- China tops the chart among the regions with severe incidents of these messages.

- 16% of people have patronized a scammer’s text to purchase service.

- An estimated 1 million spam texts are sent every minute globally.

Text Message Scams: How Do They Work?

First, let’s do some defining of terms. Smishing is another term for text scamming and is short for “SMS Phishing”. So what is SMS and what is Phishing? SMS stands for “short message service” and is the same thing as texting. Phishing basically means “fishing for information” and uses a “ph” instead of an “f” since hackers often do the same.

So, there you have it. “Smishing” is simply short for “text scamming”, a common form of identity theft scammers use in the hopes of gaining the trust of an unsuspecting target to get valuable, typically financial, information. Smishing messages typically ask consumers to provide usernames and passwords, credit and debit card numbers, bank account numbers, social security numbers, PINs, or other personal details that scam artists can use to commit fraud.

Dangers of Text Message Scams

Far and away, the majority of spam texts are designed to trick you into clicking on a link. If you do, it will take you to a fake website that steals your personal information and login credentials. The suspicious link a victim clicks on can also install damaging malware onto their computer and in some cases, onto a larger computer network.

Common Text Scams

According to the Federal Trade Commission (FTC), these are the five most common imposter scams people described:

- Scammers send bogus alerts about suspicious activity or unauthorized charges on your account

- Scammers send you phony notices saying they’re going to charge you hundreds of dollars to renew a subscription, often impersonating Best Buy’s Geek Squad tech support service. Find out how to recognize a fake Geek Squad renewal scam.

- Scammers try to trick you into paying for things like fake discounts, bogus giveaways, or non-existent prizes.

- Scammers make bogus allegations implying you committed a crime but then claim they’ll connect you with someone who’ll help.

- Scammers send you fake delivery notifications to trick you into giving up your financial information and have been known to impersonate the U.S. Postal Service and FedEx.

Identifying and Avoiding Scams

While the immediacy and sense of urgency that a text message can create with their victim targets is making it a channel of choice among scammers, there are some simple ways to spot a text scam and actions to take if you believe you are a target.

- Suspicious Sender: The first and easiest way to spot a scam is when the message is from an unexpected or unknown sender. The most dangerous of these is when they look like they’re coming from a trusted source, like a bank or the IRS. Remember, if the sender seems suspicious, there is no harm in pausing and investigating further.

- Urgency and Threats: Another way to spot a scam is when there is a strong sense of urgency to take immediate action or even a threat that one of your accounts will be compromised if you don’t take the required action.

- Suspicious Links: As often as not, text scammers create links that look legitimate and therefore safe to click. These links often take the unsuspecting victim to what seems like another legitimate webpage where they will be asked for sensitive information or, on other instances, the link might download damaging malware.

Remember, a legitimate source of communication will never send you unsolicited text messages or links, ask you to click on a link to log in to your account, or ask you what seem like inappropriate questions.

If you feel you have been a target of a text scam attempt, there are immediate actions you can take:

- Pause and verify the source of the text as legitimate before responding or clicking on a link.

- Report suspicious messages to the entity (bank, IRS, mortgage company, credit card company, etc.) the scammer is pretending to be.

- Forward suspicious online communications to the Anti-Phishing Working Group at reportphishing@apwg.org.

- Report the phishing attempt to the FTC at ReportFraud.ftc.gov.

It only takes a second to make a decision online that can do great harm to your personal or business financial situation. Remember, it’s your sensitive information and no one else’s. Be vigilant. There’s no crime in being suspicious of unexpected online communications, especially when there’s urgency and you’re being asked for sensitive information that isn’t typical from a reliable source.

At Central Bank, we take your privacy and financial security very seriously, which is why you can count on us to only ask questions that are necessary. Visit us to learn the type of questions we don’t ask.