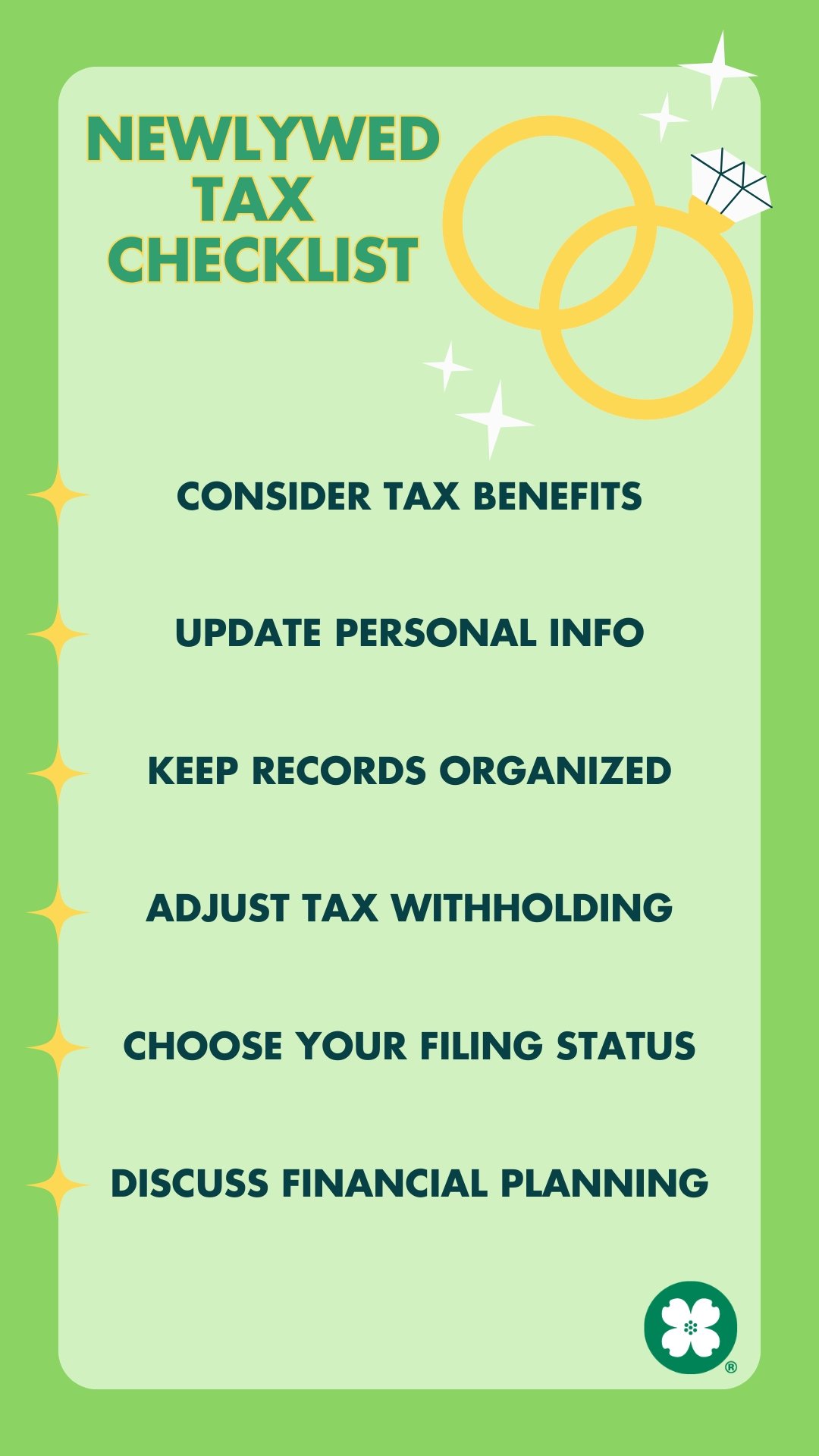

- Name Changes: Newlyweds who change their name after marriage should report it to the Social Security Administration (SSA) as soon as possible. The name on a person's tax return must match what is on file at the SSA. If it doesn't, it could delay any tax refund. For questions about this process, newlyweds should contact an SSA office.

- Address Change: If marriage means an address change, you should inform the IRS. This can be done by sending the IRS Form 8822, Change of Address. Newlyweds should also notify the postal service to forward their mail.

- After tying the knot, couples should adjust their tax withholding. Newlyweds need to send in a Form W-4 to their employers within 10 days to reflect any changes. If both partners work, watch out for a higher tax bracket or an extra Medicare tax! Read up on resources on federal withholding tax to help.

- You can choose to file your federal income taxes jointly or separately each year. Most couples find filing jointly works best, but make sure to check what works best for you. If a couple is married as of December 31, the law states they’re married for the entire tax year for federal withholding tax purposes.

- Look into tax credits and deductions available to newlyweds. If one spouse has a significantly lower income, filing jointly can lower your overall tax bracket, reducing your tax bill.

- Newlyweds should sit down together to discuss financial goals and how they relate to tax strategies. Consider consulting a tax professional for tailored advice. They can help you navigate tax laws, identify potential savings, and ensure you’re making the most of your newlywed status.

- Newlyweds should maintain records of all relevant financial documents. This includes income statements, receipts for deductions, and records of any tax payments made throughout the year. Having everything organized makes it easier to address any questions or audits that may arise. A little organization now can save you a lot of stress later!