What is compound interest?

Compound interest is the interest on a deposit calculated based on both the initial principal and the accumulated interest from previous periods. More simply put, compound interest is interest you earn on interest. You can calculate compound interest on different frequency schedules.

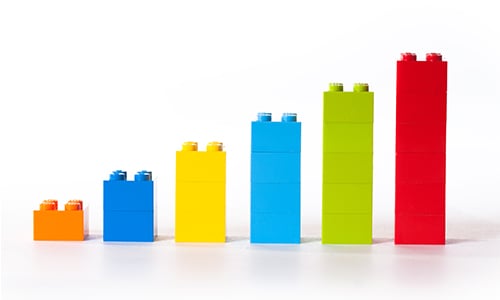

The higher the number of compounding periods, the greater the compound interest. Think about it like a snowball. The sooner you start saving and the more money you add to your snowball, the larger it will grow. Now, imagine pushing the snowball down a snow-covered hill. The snow you already packed will stay, and you’ll accumulate more snow. When your snowball reaches the bottom of the hill, it will contain the snow you started with, the snow it picked up along the way, and even more snow on top of that.

In other words, the interest-on-interest effect can generate continually increasing returns based on your initial investment amount. So, the more frequently you save and the larger the amount you save, the larger your returns will be. This phenomenon is also called “the miracle of compound interest.”

Why is Compound Interest Important?

Compound interest causes your wealth to grow faster. It allows a sum of money to grow at a faster rate than simple interest because you earn returns not only on your initial investment but also on the accumulated returns at the end of every compounding period. This means you don’t have to set aside as much money to reach your financial goals!

The magic of compounding can be an important factor in building your wealth. The earlier you open an interest-bearing account and start saving money, the more you will earn in compound interest. It’s also key to mitigating wealth-eroding factors like the rising cost of living, inflation, and reduction of purchasing power.

Compound Interest Calculator

To simplify the process, consider using a compound interest calculator to easily determine your potential returns.

To calculate compound interest, multiply the initial principal by one plus the annual interest rate raised to the number of compounding periods, then subtract one. When calculating compound interest, the number of compounding periods makes a significant difference. The higher the number of compounding periods, the greater the compound interest.

The Rule of 72

The Rule of 72 is a quick way to estimate how long it will take for your investment to double at a given annual interest rate. Simply divide 72 by your annual interest rate, and the result will give you the approximate number of years needed for your initial investment to double through compound interest.

How Started with Compounding Interest

Be sure to consult with your tax advisor or financial advisor on the best way for you to get started.