As small business owners manage the complexities of either starting or acquiring a small business and steering it toward success, one of the most critical aspects to consider is the approach to human resources.

Even the issue of human resources itself is vast, with several important decisions to be made regarding the recruitment, management, compensation and retention of employees, among others.

How about your approach to staffing? How much work needs to be done to create the business units you can sell? How much expertise do you need and what kind? And at what pay level?

Contract vs. Full-Time Employees

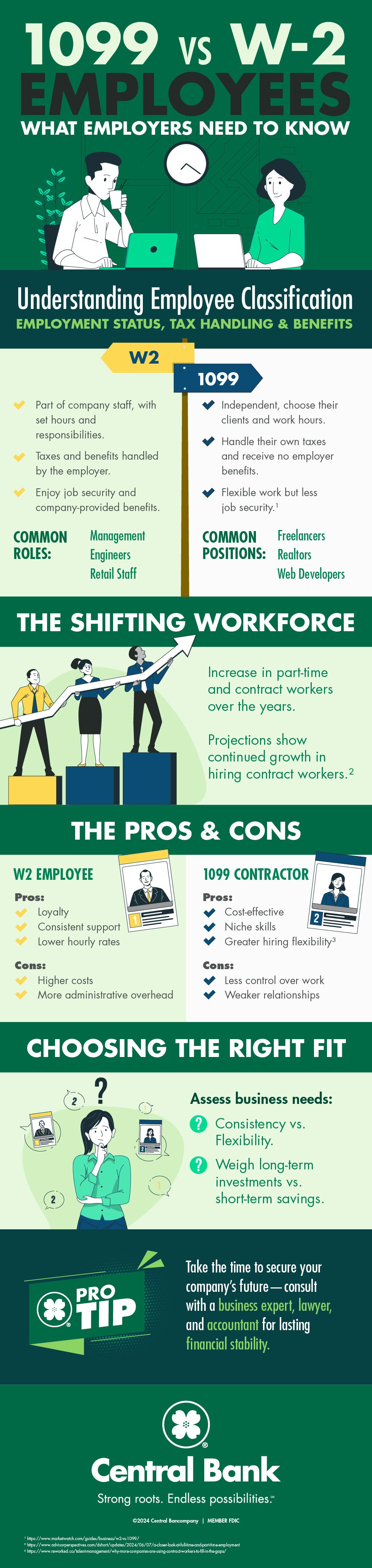

There are two primary classifications for U.S. workers: W-2 (typically full-time employees) and 1099 contractors. These classifications exist to define the working relationship, tax responsibility, benefit eligibility, job security and more. These are sometimes referred to as exempt and non-exempt employees.

Key Differences Between W-2 and 1099 Workers:

- Employment Status - W-2 employees are legally considered part of the company's staff, with typically set hours and responsibilities. Unless they are terminated with or without cause, they have job security and a predictable environment. 1099 contractors decide who they do work for and how much - and often when - they work.

- How Taxes are Handled - Employers automatically deduct federal, state and local taxes from their W-2 workers' paychecks, as well as Social Security and Medicare. It's important to know that the employer has to match several of those taxes. In contrast, 1099 contractors get gross pay rather than net pay, and must calculate and pay federal, state and local income taxes as well as the entirety of the 15.3% FICA payroll taxes after the fact.

- Employee Benefits - Employers usually offer subsidized benefits to their full-time W-2 employees. These additional perks of the job lead to overall job stability and better culture that ultimately leads to loyalty and less employee turnover. 1099 contractors, in contrast, are not eligible for most of the company benefits - such as healthcare insurance and retirement plans - that a full-time worker enjoys.

- Job Independence and Security - W-2 employees tend to have more stable and predictable income, but with less independence in how they do their jobs. While 1099 contractors can often set their hours and choose their clients, their income is less stable and work schedules less predictable.

Examples of W-2 and 1099 Workers:

- W-2 workers are often essential staff such as management, engineers, manufacturing staff, retail staff, project managers and administrative workers.

- Common roles that classify as 1099 workers are accountants/bookkeepers, freelance writers and designers, realtors, web developers and building contractors.

What Are the Trends?

The Labor Department has been collecting this since 1968, a time when only 13.5% of US employees were part-timers. Over 55 years later, the total number of part-time workers has reached 17% and is growing, with some sources reporting a more than 20% contractor workforce.

The trend of hiring contract workers is expected to grow significantly still in the coming years. MBO Partners research shows that almost 8 out of 10 corporations (77%) expect their use of contract workers to increase substantially (33%) or increase somewhat (44%).

There are a few reasons for this growth in a part-timer or contractor workforce:

- Agility. Contract workers are particularly useful for shorter term projects, like testing a new software or overhauling a website. They allow core full-time employees to tend to key tasks while delegating one-off projects to contractors. Also important to agility is that contract workers often provide a very narrow, often specialized set of skills that can be difficult to find elsewhere.

- Scalability. In the current economic environment, companies are struggling to grow, despite sustained high demand. The problem is labor availability. To help them deliver on demand and grow their business, leaders are expanding their talent search well beyond their usual geographic area.

- Cost. Having a contingent workforce has a very appealing cost advantage for companies — particularly at a time when organizations are trying to do more (or the same) with less. On one hand, employers don't have to manage employment taxes, health insurance coverage, retirement benefits and many other such expenses as they would for their full-time workers. On the other, organizations can pay contractors for the exact number of hours worked to accomplish a specific goal, and free core employees from tasks that eat away at their productivity.

Benefits of Hiring W-2 Employees:

- Company loyalty and consistent support. Full-time employees enjoy the stability of their work life, job security and company benefits. These are important factors in the loyalty and consistent support they show their employers.

- Lower hourly rates. Generally, when broken down to hourly rates, employers can expect to pay a higher rate to contractors than their full-time workers.

Challenges of Managing W-2 Employees:

- Higher costs due to salaries, benefits, and perks.

- Administrative overhead of managing schedules, training, and payroll.

- Time Commitment. There is often a skill gap between W-2 employees and their 1099 counterparts that results in additional training of W-2 employees. Employers usually need to spend much more time training W-2 employees than just hiring a 1099 contractor.

Advantages of 1099 Contractors:

- Cheaper Work. Because 1099 contractors are not full-time employees, employers don't need to pay them as much in benefits, wages and other reimbursements.

- Greater Freedom. For employers, greater freedom is beneficial as they are not overly committed to the worker. If employers are unsatisfied with a freelancer, they don't need to go through the troublesome process of firing them and can just choose never to hire them again.

- Niche Skills. A 1099 worker can be a great option if an employer is looking for someone to complete a specific task or specific project, but one that doesn't come up often.

Drawbacks of Using 1099 Contractors:

- Less Stability. This can be a serious disadvantage for employers who like to have much control over their employees. Contractors typically work whenever they want and require very little supervision. This can mean that it's hard for employers to tell them how they want the project completed.

- Weaker Relationship. This can be hard on employers who want to build stronger bonds and greater worker morale with contractors and tough on contractors.

How do you Decide?

While there are many factors, many summarized in this article, to consider in determining the make-up of your workforce, at its core it comes down to your business needs and the financial considerations:

- Assessing business needs: consistency vs. flexibility.

- Assess the costs: long-term investment in full-time W-2 workers versus short-term cost savings with 1099 contractors.

This is an important decision with long-term financial ramifications that will impact the health of your company and potentially the financial well-being of you and your family. Because of this, it's always a good idea to spend ample time with a business consultant, lawyer and accountant. There are also helpful resources online on this important subject.