The spring and summer months are a great time to take a hard look at your accounts and identify ways to manage them more efficiently. By getting your finances in order, you can set the stage for a stronger, more successful future.

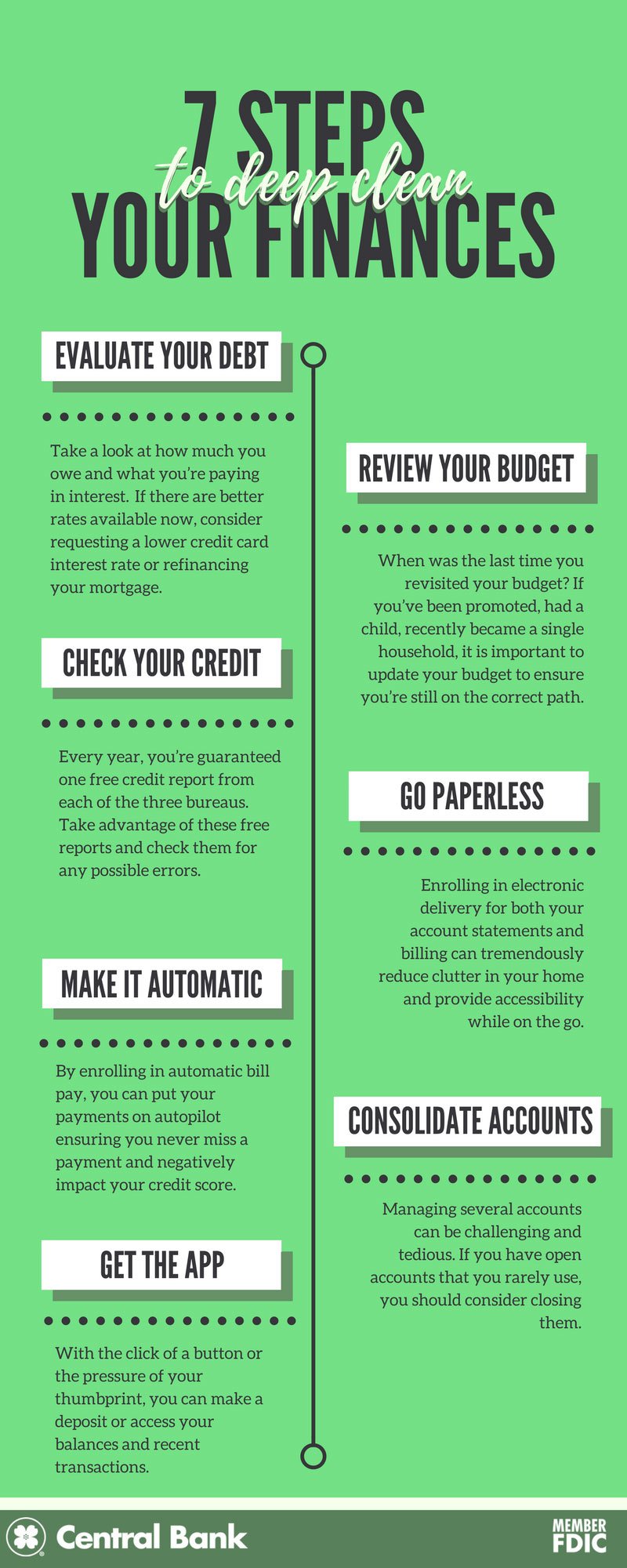

Check out these seven tips for re-evaluating your finances:

1. Evaluate and pay down your debt.

Your debt is a great place to start when it comes to cleaning up your finances. Take a look at how much you owe and what you're paying in interest. This includes credit cards, loans, or any other outstanding balance. If there are better rates available now, consider requesting a lower credit card interest rate or refinancing your mortgage. Creating a plan of action can be tricky; however a great rule of thumb is to focus on balances with higher interest rates or small balances first.

2. Review your budget (and stick with it).

When was the last time you revisited your budget? With any life event, comes the need to take a new look at your monthly spending and re-evaluate your overall budget. If you've been promoted, had a child, recently became a single household, it is important to update your budget to ensure you're still on the correct path. Determine what expenses demand the most money and identify areas where you can realistically cut back. Utilize online budgeting tools, such as Money Manager, to monitor your spending and create customized savings goals that will help you stay on track with your budget.

3. Check your credit report for errors.

Every year, you're guaranteed one free credit report from each of the three bureaus. Take advantage of these free reports and check them for any possible errors. Mistakes in your credit report can negatively impact your score and prevent you from getting a loan, or cause you to pay a higher than necessary interest rate. It's important to understand exactly what makes up your credit score and how you can improve it.

4. Sign up for paperless statements and billing.

Enrolling in electronic delivery for both your account statements and billing can tremendously reduce clutter in your home and provide accessibility while on the go. In addition, going paperless will enhance your account security by eliminating the risk of your personal information landing in the wrong hands.

5. Set up automatic bill pay.

By enrolling in automatic bill pay, you can put your payments on autopilot ensuring you never miss a payment and negatively impact your credit score. You can create recurring payments, choose where to withdraw the funds, and edit payees as needed.

6. Consolidate your accounts.

Managing several accounts can be challenging and tedious. If you have open accounts that you rarely use, you should consider closing them. It's important to note that cancelling accounts may come with a fee or impact your credit score. Other options include streamlining all your accounts under a single bank, or using a personal financial management service that allows you to view all of your financial accounts, credit cards, bills, and budget in one location under a single password.

7. Download our mobile app.

Many banks now offer mobile banking apps that allow consumers to manage their finances from the palm of their hand and from virtually anywhere with a data or internet connection. With the click of a button or the pressure of your thumbprint, you can make a deposit or access your balances and recent transactions.

American Bankers Association